What solar incentives are available in Florida?

In addition to drastically reducing or eliminating your electric bills and contributing to a cleaner environment.. you can also benefit from several local and federal incentives.

These incentives and programs are designed by the government to encourage homeowners to go solar.

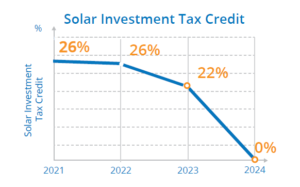

The Solar Investment Tax Credit (ITC) is a federal tax credit for qualified

customers who purchase solar energy systems for residential properties.

The credit is worth 26% of the total cost of the system and is applied to the homeowners income tax. In 2023 the ITC will be reduced to 22% and it will no longer be available after 2024.

For more information on the Solar ITC: https://blog.vinyasun.com/what-is-solar-investment-tax-credit-itc/

Net-metering is a utility billing system that offers a credit to residential and business customers who are making excess electricity with their solar systems and sending it back to the grid. Florida homeowners with solar are able to sell back the excess energy produced by their system.

Solar energy systems are completely exempt from sales tax in Florida, which saves you 6% of the total cost of your new solar system.

Unlike other home improvements like new kitchens, additions or pools, Florida homeowners never have to worry about the government adding property taxes to their home when they install a solar energy and backup battery system.

For more information on Florida’s Property Tax Abatement for Renewable Energy Property: https://programs.dsireusa.org/system/program/detail/5426